Industry Profile: Finance

This guide will help you find the information you need to start working in British Columbia. You can use the menu buttons to move between sections of the guide.

The finance, insurance, real estate & leasing industry accounts for about one-quarter of B.C.’s total GDP, with finance & insurance accounting for 5.9%

Businesses in the finance, insurance and real estate industry provide services related to financial transactions. The finance industry is comprised mostly of banks, credit unions, advisors and brokers. There is also a growing cluster of financial technology (fintech) companies.

Finance businesses conduct and facilitate financial activities such as day-to-day transactions, lending, borrowing and the sale of investment products. Financial institutions are mainly engaged in taking deposits, issuing securities and lending money. They carry the risk themselves and act as a connector between lenders and borrowers.

Sources: WorkBC Industry Outlook Profile, Finance [select ‘Finance’], British Columbia Financial and Economic Review

Financial services companies employ approximately 60,000 people in Metro Vancouver. Vancouver performs particularly well in four financial services subsectors: banking, credit unions, international financial transactions and venture capital investment. All five of Canada’s largest banks have operations in Vancouver, along with several international banks.

The credit union system in BC is the largest among Canada’s English-speaking provinces, and is a significant contributor to the growth in Vancouver’s financial services sector.

Local financial services companies operate in global markets, including the United States and emerging Asian economies. BC was the first foreign government to sell bonds into China’s domestic market, and in 2015 Vancouver became a Reminbi (RMB) clearance centre.

Metro Vancouver’s FinTech Sector

There is a growing cluster of financial technology (fintech) companies in Metro Vancouver focused on delivering products and services that challenge traditional notions in the financial services industry. Vancouver is ranked 12th amongst 20 fintech hubs globally.

British Columbia is currently home to over 120 fintechs, with most located in Metro Vancouver. Some of the larger companies include Chime, Hyperwallet, Grow, Trulioo, Koho, FISPAN and Mogo. In early 2020, the federal government invited MasterCard to open its sixth global technology centre in the city, with a total planned investment of C$510 million.

Source: Accenture 2021 Canadian Fintech Report

BC Job Openings

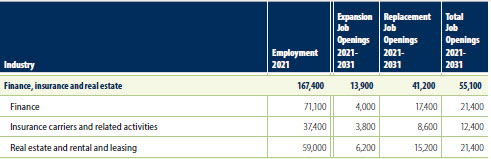

The finance industry is projected to have 21,400 total job openings over the 10-year period from 2021-2023.

New job openings come from either retirements or because of economic growth. The need to replace retiring workers will create the majority of projected job openings in the finance industry over the next ten years.

Finance Industry – Employment & Job Openings in BC 2021-2031

Source: BC’s Labour Market Outlook, 2021